Continue the Comeback  the Strategy Group Company

As of July 18, 2022

Uncertainty colored the market narrative during the first half of the year, with record-high inflation, surging energy prices, tightening monetary policies, slowing growth trends, weak investor/consumer sentiment, ongoing supply disruptions, a war in Ukraine, and China COVID-19 lockdowns. Unfortunately, at the year's midpoint, there aren't many positive catalysts out there ready to shift the market narrative over the near term.

Stocks suffered their worst first half of performance in more than 50 years

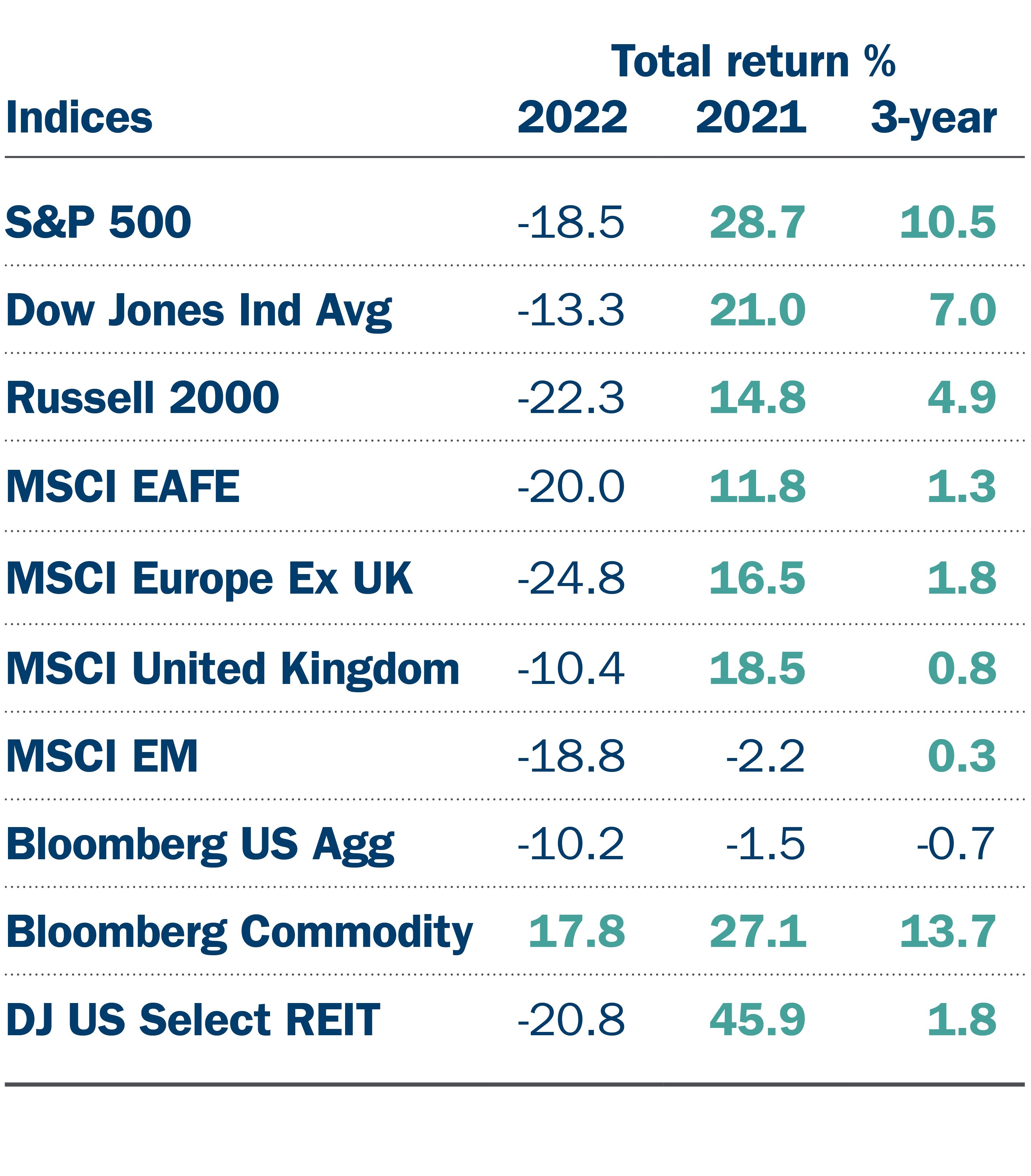

- The S&P 500® Index finished its worst first half of performance since 1970, and its worst quarter since Q1'20, when the U.S. was in the throes of the pandemic and the global economy was shut down. The S&P 500 closed the first half of the year down 20%, dropping by roughly 16% in the second quarter alone.

- The NASDAQ Composite closed its worst three-month stretch since the financial crisis in 2008. The NASDAQ Composite slid almost 30% in the year's first half and fell over 22% in Q2.

- A choppy rise in U.S. Treasury yields during the first half was a meaningful headwind for equities, particularly across growth areas.

What's ahead?

While economic, consumer, and business activity is slowing, stock prices eventually look past the present. In the previous eight times since WWII that the S&P 500 dropped by 15% or more in a quarter, the Index was higher over the next year. Similarly, the U.S. stock benchmark declined by 20% or more in the year's first half on seven other occasions. In every instance, the S&P 500 was higher a year later, and by a significant amount.

In our view, by the time it's clear the U.S. is in, entering, or was able to avoid a recession, stocks most likely will have rebounded before the signals are obvious.

Recession fears build as the second half begins

Bloomberg recently highlighted that since WWII, economic contractions in the U.S. have averaged a decline in growth of 2.5% and lasted 10 months, with the unemployment rate rising by roughly 3.8% and corporate earnings falling by 15%. However, if the U.S. economy falls into a recession this time, fiscal and monetary support will likely be lacking as inflation remains high.

Some indications suggest that a possible recession could be shallow if the U.S. economy continues to contract. Consumer and corporate balance sheets remain solid, there are no extreme imbalances in the economy, and the labor market is tight. That said, an increasing number of consumers may already feel like we are entering or in a recession and more data points to a growth slowdown in the coming months.

What's ahead?

We believe the quicker the market fully prices in a recession or growth slowdown, the faster the market will look for signals that the bottom has been put in. Unfortunately, we expect further stock declines to develop if economic and corporate profitability decline in the weeks and months ahead. But once the market believes the worst is behind us, the tone and narrative could shift quickly. Historically, such a shift has provided a strong tailwind for stock prices over the next year when the focus moves toward embracing the potential benefits of the next economic expansion.

Stocks could see more volatility in the second half

Volatility is likely to continue as long as investors remain concerned about the path of inflation and interest rates and how aggressively growth slows. Cooling inflation in the second half could remove some pressure on the Federal Reserve to keep hiking rates aggressively. We believe stocks would react positively to such a development and if the U.S. economy can avoid a recession. But inflation pressures that prove sticky and keep the Fed aggressively pressing rates higher could keep stock prices on the defensive.

What's ahead?

The Q2 earnings season, including updates on company fundamentals and business outlooks, will likely play a prominent role in directing stock traffic over the coming weeks. There is a growing risk that more companies could warn that their outlooks for the rest of the year may not live up to expectations, given high input costs, cooling demand, and ongoing supply dislocations. We suspect stocks would find it difficult to gain their footing in such an environment.

However, we believe current stock valuations reflect some degree of pending disappointment in the upcoming earnings season. The key question is how much disappointment is already reflected in current stock prices. And, if S&P 500 companies meet or surprise the upside in aggregate, how much of a tailwind could that provide to stock prices, given all the other uncertainties currently.

What steps can investors take?

We believe investors should take steps today to insulate risk in their portfolios on the margin and in accordance with a properly diversified portfolio. Keep this point in mind: Bear markets usually accompany drawdowns in economic activity and corporate profitability. However, market bottoms form once all the bad news is priced into stocks and investors stop driving equities lower on weaker data. At that point, stocks usually turn the tide and begin discounting better days ahead.

History suggests investors want to be well-positioned to participate in the upside that follows severe market downdrafts when that tide ultimately shifts.

As the second half of the year begins, investors should continue to lean on the strategies that helped mitigate volatility in the first half.

- Focus on maintaining a disciplined and diversified portfolio of high-quality investments.

- Dividends also add a layer of income that can provide some relief in an otherwise sour market environment.

- Fixed income now offers attractive opportunities, as higher yields and less correlated movements with stocks enhance diversification properties.

- Alternative strategies can help reduce volatility and mitigate risk across equity exposure.

Contact your Ameriprise financial advisor for more details on our market and economic outlook as well as portfolio strategies that can help you navigate the second half of the year.

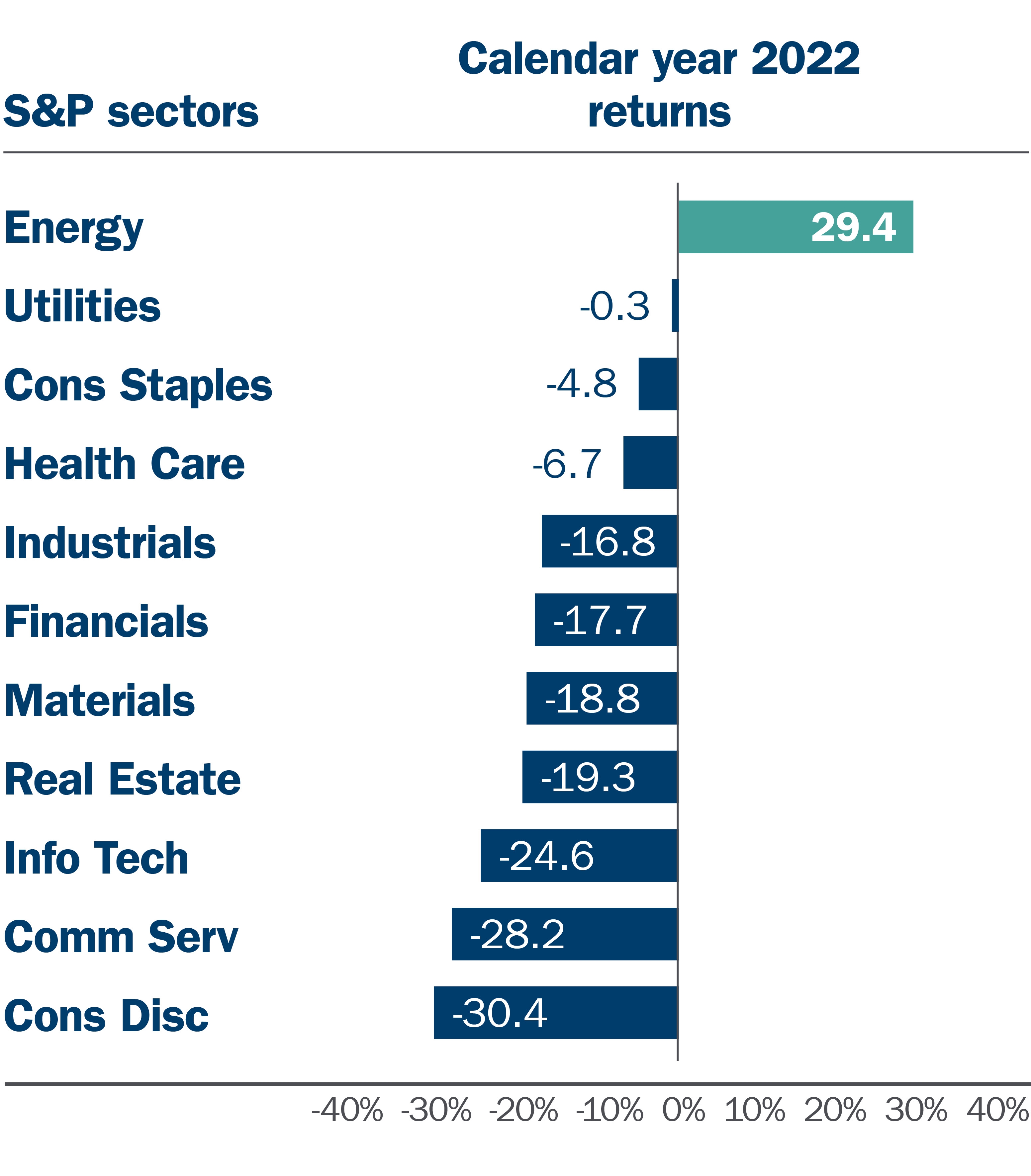

Data source for indices and sector graphs: Morningstar Direct, as of July 11, 2022.Past performance is not a guarantee of future results.

Source: https://www.ameripriseadvisors.com/team/genvest-strategy-group/insights/can-stocks-make-a-comeback-in-the-second-half/

0 Response to "Continue the Comeback  the Strategy Group Company"

إرسال تعليق